UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑ | Filed by a Party other than the Registrant ☐ | ||

|

| ||

Check the appropriate box: | |||

☐ |

| Preliminary Proxy Statement | |

☐ |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☑ |

| Definitive Proxy Statement | |

☐ |

| Definitive Additional Materials | |

☐ |

| Soliciting Material under §240.14a-12 | |

Celsion Corporation | ||

(Name of Registrant as Specified In Its Charter) | ||

N/A |

| |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

☑ |

| No fee required. | ||

☐ |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

| |||

(1) |

| Title of each class of securities to which transaction applies: | ||

|

| (2) |

| Aggregate number of securities to which transaction applies: |

|

| (3) |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| (4) |

| Proposed maximum aggregate value of transaction: |

|

| (5) |

| Total fee paid: |

☐ |

| Fee paid previously with preliminary materials. | ||

☐ |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

| |||

(1) |

| Amount Previously Paid: | ||

|

| (2) |

| Form, Schedule or Registration Statement No.: |

|

| (3) |

| Filing Party: |

|

| (4) |

| Date Filed: |

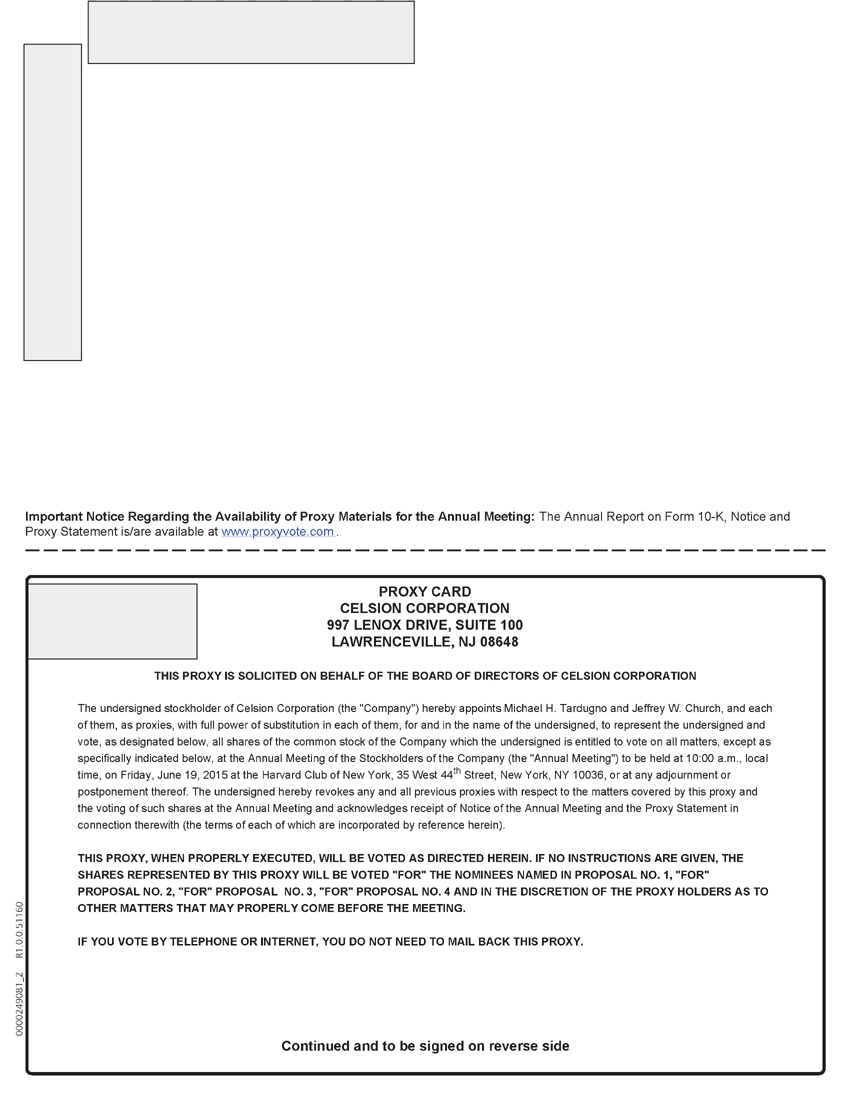

CELSION CORPORATION

997 LENOX DRIVE, SUITE 100

LAWRENCEVILLE, NJ 08648

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FRIDAY, JULYJUNE 19, 20132015

To Our Stockholders:

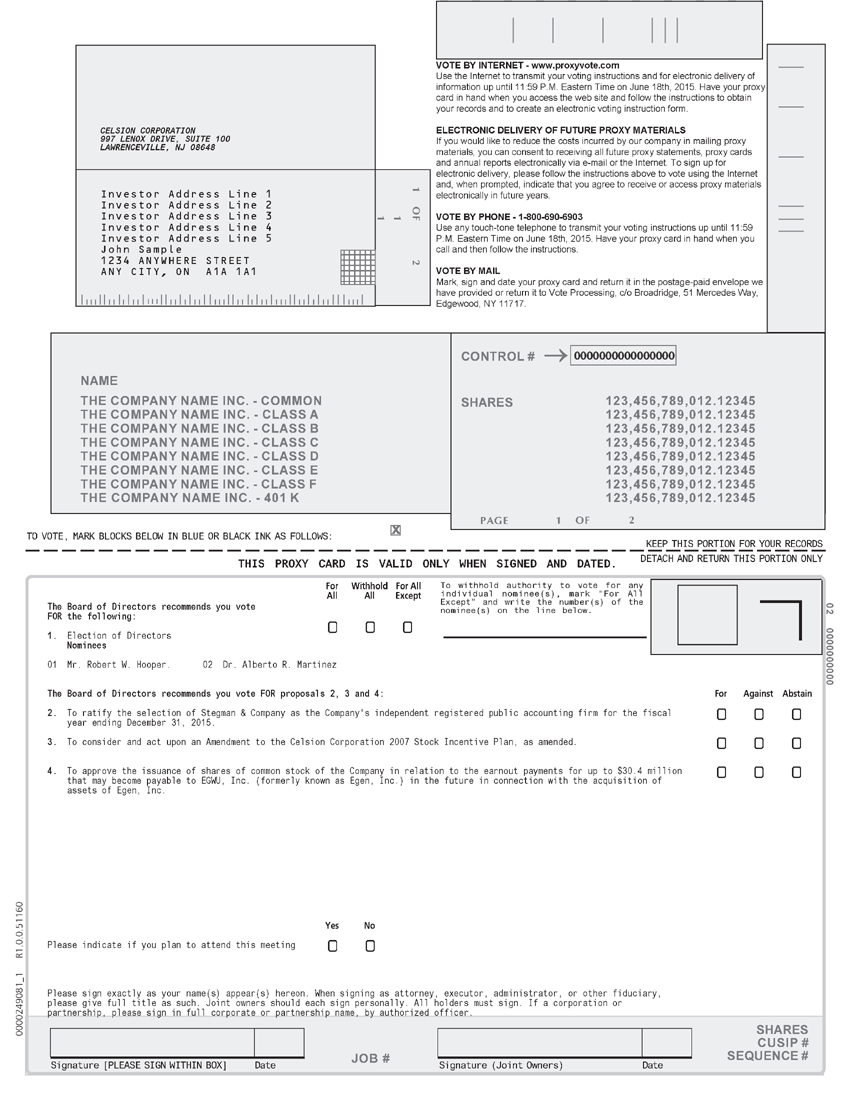

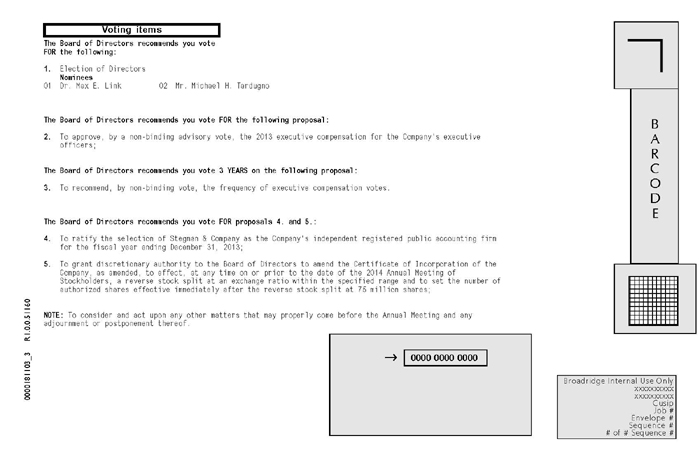

Notice is hereby given that the annual meeting (the "Annual Meeting") of the stockholders of Celsion Corporation, a Delaware corporation (the "Company"), will be held at 10:00 a.m., local time, on Friday, JulyJune 19, 20132015 at the Harvard Club of New York, 35 West 44th Street, New York, NY 10036,for the following purposes, all as more fully described in the accompanying Proxy Statement:

| 1) | To elect two Class |

| 2) |

|

|

|

| To ratify the selection of Stegman & Company as the Company's independent registered public accounting firm for the fiscal year ending December 31, |

3) | To consider and act upon an Amendment to the Celsion Corporation 2007 Stock Incentive Plan, as amended; |

4) | To approve the issuance of shares of common stock of the Company in relation to the earnout payments for up to $30.4 million that may become payable in the future in connection with the acquisition of assets of EGWU, Inc. (formerly known as Egen, Inc.); and |

| 5) |

|

| To consider and act upon any other matters that may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The close of business on MayApril 24, 20132015 has been fixed as the record date for the determination of stockholders of the Company entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on MayApril 24, 20132015 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

All stockholders are cordially invited to attend the Annual Meeting. However, whether or not you expect to attend in person, please complete, sign, date and return the enclosed Proxy Card as promptly as possible in the envelope provided for that purpose. Returning your Proxy Card will ensure your representation and help to ensure the presence of a quorum at the Annual Meeting. Your proxy is revocable, as set forth in the accompanying Proxy Statement. Therefore, you may attend the Annual Meeting and vote your shares in person even if you send in your Proxy Card.

|

| By Order of the Board of Directors | |

|

|

| |

/s/Jeffrey W. Church | |||

|

| Jeffrey W. Church Corporate Secretary |

June 7, 2013April 30, 2015

Lawrenceville, NJ

YOUR VOTE IS IMPORTANT

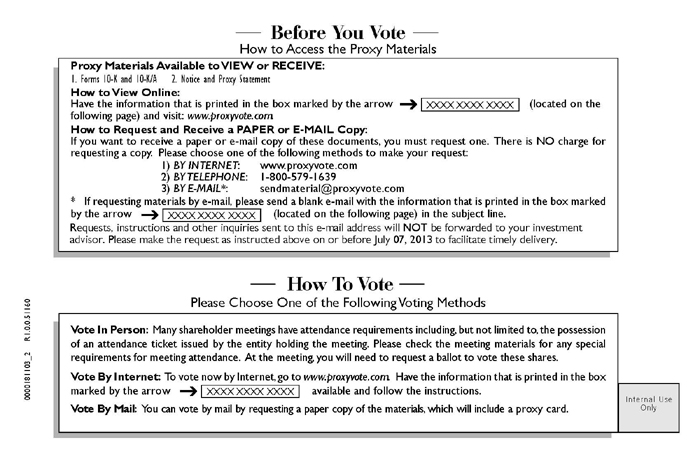

THIS PROXY STATEMENT IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE COMPANY, ON BEHALF OF THE BOARD OF DIRECTORS, FOR THE 20132015 ANNUAL MEETING OF STOCKHOLDERS. THE PROXY STATEMENT AND THE RELATED PROXY FORM ARE BEING DISTRIBUTED ON OR ABOUT JUNE 7, 2013.MAY 6, 2015. YOU CAN VOTE YOUR SHARES USING ONE OF THE FOLLOWING METHODS:

• |

| COMPLETE AND RETURN A WRITTEN PROXY CARD |

| • |

| ATTEND THE COMPANY’S |

• | VOTE VIA THE INTERNET AT WWW.PROXYVOTE.COM | ||

• | VOTE BY PHONE BY CALLING THE NUMBER PRINTED ON THE ACCOMPANYING VOTING DOCUMENT |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE URGED TO MARK,COMPLETE, SIGN, DATE AND RETURN THE ENCLOSEDACCOMPANYING PROXY CARD AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PREPAID ENVELOPE ENCLOSED FOR THAT PURPOSE.PURPOSE, OR SUBMIT YOUR VOTE VIA THE INTERNET ATWWW.PROXYVOTE.COM OR VOTE BY PHONE BY CALLING THE NUMBER PRINTED ON THE ACCOMPANYING VOTING DOCUMENT. ANY STOCKHOLDER ATTENDING THE MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE HAS RETURNED A PROXY CARD.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JULYJUNE 19, 2013.2015. THE PROXY STATEMENT AND OUR 20122014 ANNUAL REPORT TO SECURITY HOLDERS ON SECURITIES AND EXCHANGE COMMISSION FORM 10-K AND FORM 10-K/A ARE AVAILABLE ATWWW.PROXYVOTE.COM.

WHETHER OR NOT YOU INTEND TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED PRE-ADDRESSEDAND POSTAGE-PAID ENVELOPE OR SUBMIT YOUR VOTE VIA THE INTERNET AT WWW.PROXYVOTE.COM OR BY CALLING THE NUMBER PRINTED ON THE ACCOMPANYING VOTING DOCUMENT.

CELSION CORPORATION

PROXY

STATEMENT

TABLE OF CONTENTS

| Page | ||

Information Concerning Solicitation and Voting |

| 1 | |

Information About the Annual Meeting |

| 1 | |

| Date, Time and Place of the Annual Meeting |

| 1 |

| Who May Attend the Annual Meeting |

| 1 |

| Who May Vote |

| 1 |

| How to Vote |

|

|

| Voting by Proxy |

| 2 |

| Quorum Requirement |

|

|

| Vote Requirements |

| 3 |

| Other Matters |

| 3 |

| Information about the Proxy Statement and the Solicitation of Proxies |

| 3 |

| Annual Report |

| 4 |

|

|

| 4 |

Beneficial Ownership of Common Stock |

| 5 | |

Section 16(a) Beneficial Ownership Reporting Compliance |

| 7 | |

Code of Ethics |

| 7 | |

Certain Relationships and Related Party Transactions | 7 | ||

Proposal No. 1: Election of Directors |

| 8 | |

| General |

| 8 |

| Directors, Executive Officers and Corporate Governance |

| 9 |

| Legal Proceedings |

|

|

| Board Leadership Structure and Role in Risk Oversight |

| 11 |

| Committees of the Board of Directors |

| 11 |

| Meetings of the Board and Its Committees |

|

|

| Director Nominations |

| 13 |

| Stockholder Communications |

| 15 |

| Board Attendance |

|

|

Director Compensation |

| 16 | |

|

|

| 16 |

| Compensation Committee Interlocks and Insider Participation |

| 17 |

| Stock Ownership |

| 17 |

| Report of the Audit Committee |

| 18 |

Executive Compensation |

| 19 | |

| Compensation Discussion and Analysis |

| 19 |

| Compensation Committee Report on Executive Compensation |

|

|

|

|

|

|

| Narrative Disclosure to Summary Compensation Table |

|

|

|

|

| |

2014 Grants of Plan-Based Awards |

|

| |

|

|

|

|

| Option Exercises and Stock Vested |

|

|

| Potential Payments Upon Termination or Change in Control |

|

|

Proposal No. 2: |

| ||

|

| ||

|

|

| |

Proposal No. |

| 33 | |

| 43 | ||

Stockholder Nominations and Proposals for the |

| 48 | |

| 48 | ||

CELSION CORPORATION

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Celsion Corporation, a Delaware corporation (sometimes referred to in this Proxy Statement as the "Company", "Celsion", "we" or "us"), for exercise in voting at the Company’s 20132015 Annual Meeting of Stockholders to be held on Friday, JulyJune 19, 20132015 (the "Annual Meeting") for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. We are first sending this Proxy Statement, accompanying Proxy Card, Notice of Annual Meeting of Stockholders and Annual Report on Securities and Exchange Commission ("SEC") Form 10-K and Amendment No. 1 to the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2012 (collectively our "20122014 ("2014 Annual Report on Form 10-K and Form 10-K/A"10-K") to our stockholders on or about June 7, 2013.May 6, 2015.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on Friday, JulyJune 19, 2013.2015. The Proxy Statement and our 20122014 Annual Report on Form 10-K and Form 10-K/A are available atwww.proxyvote.com or you may request a printed or electronic set of the proxy materials at no charge. Instructions on how to access the proxy materials over the Internet and how to request a printed copy may be found on the Notice.

In addition, any stockholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to stockholders and will reduce the impact of annual meetings on theour environment. A stockholder who chooses to receive future proxy materials by email will receive an email prior to next year’s annual meetingAnnual Meeting with instructions containing a link to those materials and a link to the proxy voting website. A stockholder’s election to receive proxy materials by email will remain in effect until the stockholder terminates it.

We are anCelsion is a fully-integrated oncology drug development company focused on developing a portfolio of innovative cancer treatments, including directed chemotherapies, immunotherapies and RNA- or DNA-based therapies. The Company's lead program is ThermoDox®, a proprietary heat-activated liposomal encapsulation of doxorubicin, currently in Phase III development for the treatment of primary liver cancer and in Phase II development for the treatment of recurrent chest wall breast cancer. The Company’s pipeline also includes GEN-1, a DNA-based immunotherapy for the localized treatment of ovarian and brain cancers. Celsion has three platform technologies for the development of treatments for those suffering with difficult to treat forms of cancer. We are working to developnovel nucleic acid-based immunotherapies and commercialize more efficient, effective, targeted chemotherapeutic oncology drugs based on our proprietary heat-activated liposomal technology.other anti-cancer DNA or RNA therapies, including TheraPlas™, TheraSilence™ and RAST™.

Our principal executive offices are located at 997 Lenox Drive, Suite 100, Lawrenceville, NJ 08648, and our telephone number is (609) 896-9100.

INFORMATION ABOUT THE ANNUAL MEETING

Date, Time and Place of the Annual Meeting

Our 20132015 Annual Meeting will be held at 10:00 a.m., local time, on Friday, JulyJune 19, 20132015 at the Harvard Club of New York, 35 West 44th Street, New York, NY 10036.

Who May Attend the Annual Meeting

Only stockholders who own our common stock, par value $0.01 per share (our "Common Stock"), as of the close of business on MayApril 24, 2013,2015, the record date for the Annual Meeting (the "Record Date"), will be entitled to attend the Annual Meeting. InAt the discretion of management, we may permit certain other individuals to attend the Annual Meeting, including members of the media and our employees.

Who May Vote

Each share of our Common Stock outstanding on the Record Date entitles the holder thereof to one vote on each matter submitted to the stockholders at the Annual Meeting.Meeting; provided, however, that pursuant to NASDAQ Marketplace Rules, the 2,712,188 shares of Common Stock issued to EGWU, Inc. (formerly known as Egen, Inc.), an Alabama corporation (“EGEN”), at the closing of the acquisition will not be entitled to vote on Proposal No. 4 and will not be counted in determining votes cast for purposes of Proposal No. 4. Only stockholders who own Common Stock as of the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 52,689,92020,005,186 shares of our Common Stock issued and outstanding.

How to Vote

If you were a holder of our Common Stock as of the Record Date, you are entitled to vote at the Annual Meeting, and we encourage you to attend and vote in person. HOWEVER, WHETHER OR NOT YOU INTEND TO ATTEND THE ANNUAL MEETING, THE BOARD OF DIRECTORS REQUESTS THAT YOU COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD IN ORDER TO ENSURE THE PRESENCE OF A QUORUM.

A pre-addressed and postage-paid return envelope is enclosed for your convenience. Alternatively, you may cast your vote via the internet atwww.proxyvote.com or by phone by calling the number printed on the accompanying voting document.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a proxy and bring it to the Annual Meeting in order to vote.

Voting by Proxy

If you vote by proxy, the individuals named on the proxy, or their substitutes, will vote your shares in the manner you indicate.

If a beneficial owner who holds shares in street name does not provide specific voting instructions to their brokerage firm, bank, broker dealer or other nominee, under the rules of certain securities exchanges, including NASDAQ Marketplace Rules, the brokerage firm, bank, broker dealer or other nominee holding those shares may generally vote as the nominee determines in its discretion on behalf of the beneficial owner on routine matters but cannot vote on non-routine matters, the latter of which results in “broker non-votes.” Proposal No. 4 and Proposal No. 5 involve2 involves matters we believe to be routine. Accordingly, no broker non-votes are expected to exist in connection with those Proposals.Proposal No. 2. Broker non-votes are expected in connection with ProposalProposals No. 1, Proposal No. 23 and Proposal No. 3.4.

Thus, if you date, sign, and return the proxy card without indicating your instructions, your shares will be voted as follows:

| ● | Proposal No. 1. |

| ● | Proposal No. 2. |

| “ |

|

|

| ● | Proposal No. |

● | Proposal No.4. “FOR” the |

| ● | Other Business. In the discretion of your proxy holder (one of the individuals named on your proxy card), on any other matter properly presented at the Annual Meeting or any adjournment or postponement thereof. |

You may revoke or change your proxy at any time before it is exercised by delivering to us a signed proxy with a date later than your previously delivered proxy, by voting in person at the Annual Meeting, or by sending a written revocation of your proxy addressed to our Corporate Secretary at our principal executive office. Your latest dated proxy card is the one that will be counted.

Quorum Requirement

A quorum is necessary to hold a valid meeting. The presence, in person or by proxy, of holders of our Common Stock entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum for the transaction of business. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. A "broker non-vote" occurs when a broker, bank or other holder of record holding shares for a beneficial owner properly executes and returns a proxy without voting on a particular proposal because such holder of record does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

Vote Requirements

Proposal No. 1. The election of the Class IIIII Directors at the Annual Meeting will be by a plurality of the votes cast. This means that the two director nominees receiving the greatest number of votes cast, in person or by proxy, by the holders of our Common Stock in the election of the Class IIIII Directors, will be elected. Stockholders may not cumulate their votes in electing directors. Stockholders entitled to vote at the Annual Meeting may either vote "FOR" the nominees for election as a director or may "WITHHOLD" authority for the nominees. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below in Proposal No. 1. If a stockholder withholds authority to vote with respect to the nominees for director, the shares held by that stockholder will be counted for purposes of establishing a quorum, but will have no effect on the election of the nominees. Broker non-votes will have no effect on the election of the nominee;nominee.

Proposal No. 2. Stockholders may vote "FOR" or "AGAINST" or may "ABSTAIN" on Proposal No. 2 to approve, by a non-binding advisory vote, the 2013 executive compensation for the Company's executive officers. The affirmative vote of the holders of a majority of the shares of our Common Stock present in person or represented by proxy and entitled to vote on the proposal will be required to ratify the 2013 executive compensation for the Company's executive officers. Abstentions will have the same effect as a vote against Proposal No. 2, but broker non-votes will have no effect on Proposal No. 2;

Proposal No. 3. Stockholders may vote for "EVERY YEAR," "EVERY TWO YEARS," "EVERY THREE YEARS" or "ABSTAIN" on Proposal No. 3 to approve, by a non-binding advisory vote, the frequency by which future advisory votes on executive compensation will occur. The time period that receives the greatest number of votes cast by the holders of our Common Stock present in person or represented by proxy and entitled to vote on the proposal will be considered the recommendation of stockholders on this proposal. Abstentions and broker non-votes will have no effect on Proposal No. 3;

Proposal No. 4. Stockholders may vote "FOR" or "AGAINST" or may "ABSTAIN" on Proposal No. 4 regarding the ratification of the selection of Stegman & Company as the Company's independent registered public accounting firm for the year ending December 31, 2013.2015. The affirmative vote of the holders of a majority of the shares of our Common Stock present in person or represented by proxy and entitled to vote on the proposal will be required to ratify the selection of Stegman & Company. Abstentions will have the same effect as a vote against Proposal No. 4; and2.

Proposal No. 5.3. Stockholders may vote "FOR" or "AGAINST" or may "ABSTAIN" on Proposal No. 5 regarding the grant of discretionary authority3, to approve an Amendment to the Board of Directors to amend the Certificate of Incorporation of the Company, as amended, to effect, at any time on or prior to the date of the 2014 Annual Meeting of Stockholders, a reverse stock split at an exchange ratio within the specified range and to set the number of authorized shares of our CommonCelsion Corporation 2007 Stock effective immediately after the reverse stock split at 75 million shares.Incentive Plan. The affirmative vote of the holders of a majority of the outstanding shares of our Common Stock on the record datepresent in person or represented by proxy and entitled to vote on the proposal will be required to grant such discretionary authority toapprove the Board of Directors.amendment. Abstentions will have the same effect as a vote against Proposal No. 5.3. Broker non-votes will have no effect on Proposal No. 3.

Proposal No. 4.Stockholders may vote "FOR" or "AGAINST" or may "ABSTAIN" on Proposal No. 4 to approve the issuance of shares of Common Stock in relation to the earnout payments of up to $30.4 million that may become payable in the future in connection with the acquisition of assets of EGEN. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the proposal will be required to approve Proposal No. 4; provided, however, that pursuant to NASDAQ Marketplace Rules, the 2,712,188 shares of Common Stock issued to EGEN at the closing of the acquisition will not be entitled to vote on Proposal No. 4 and will not be counted in determining votes cast for purposes of Proposal No. 4. Abstentions will have the same effect as a vote against Proposal No. 4. Broker non-votes will have no effect on Proposal No. 4.

Other Matters

Our Board of Directors knows of no other matters that may be presented for stockholder action at the Annual Meeting. It is not anticipated that other matters will be brought before the Annual Meeting. If other matters do properly come before the Annual Meeting, or any adjournments or postponements thereof, however, persons named as proxies will vote upon them in their discretion.

Information about the Proxy Statement and the Solicitation of Proxies

The enclosed proxy is solicited by our Board of Directors and we will bear the costs of preparing, assembling, printing and mailing this Proxy Statement, accompanying Proxy Card, Notice of Annual Meeting of Stockholders and the Company's 20122014 Annual Report on Form 10-K, and Form 10-K/A, as well as any additional materials that we may furnish to stockholders in connection with the Annual Meeting. Copies of our solicitation materials will be furnished to brokerage houses, fiduciaries and custodians to forward to beneficial owners of stock held in the names of such nominees. We will, upon request, reimburse those parties for their reasonable expenses in forwarding proxy materials to theirthe beneficial owners.

The solicitation of proxies willmay be by mail and direct communication with certain stockholders or their representatives by our officers, directors and employees, who will receive no additional compensation therefore. therefor.

We have also engaged Morrow & Co., LLC, 470 West Ave. Stamford Connecticut 06902, to assist with the solicitation of proxies for a fee of $7,500 plus reasonable out of pocketout-of-pocket expenses.

Annual Report

Our 20122014 Annual Report on Form 10-K and Amendment No. 1 to the Annual Report on Form 10-K/A areis being mailed to stockholders together with this Proxy Statement and contains financial and other information about Celsion, including audited financial statements for our fiscal year ended December 31, 2012.2014. A copy of our 20122014 Annual Report on Form 10-K, and Amendment No. 1 to the Annual Report on Form 10-K/A, as filed with the SEC, but excluding exhibits, is available on our website and additional copies may be obtained without charge, upon written request directed to the Corporate Secretary, Celsion Corporation, 997 Lenox Drive, Suite 100, Lawrenceville, New Jersey 08648.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of our Proxy Statement or 20122014 Annual Report on Form 10-K and Amendment No. 1 to the Annual Report on Form 10-K/A may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you write or call the Company at the following address or telephone number:

Celsion Corporation

997 Lenox Drive, Suite 100

Lawrenceville, New Jersey 08648

Attention: Corporate Secretary

(609) 896-9100

If you would like to receive separate copies of the Company's 20122014 Annual Report on Form 10K, Amendment No. 1 to the Annual Report on Form 10-K/A10-K and the Proxy Statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact the Company at the address and telephone number set forth above.

PLEASE COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING WHITE PROXY CARD IN THE ENCLOSED PRE-ADDRESSED AND POSTAGE-PAID ENVELOPE AS PROMPTLY AS POSSIBLE OR SUBMIT YOUR VOTE VIA THE INTERNET AT WWW.PROXYVOTE.COM OR BY CALLING THE NUMBER PRINTED ON THE ACCOMPANYING VOTING DOCUMENT.

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth certain information known to the Company regarding the beneficial ownership of the Company's Common Stock as of June 3, 2013April 24, 2015 by:

| ■ | each person or group known by us to own beneficially more than |

| ■ | each of our directors and the director nominees, as well as each executive officer named in the Summary Compensation Table appearing under the heading "Executive Compensation"; and |

| ■ | our directors and executive officers as a group. |

We determine beneficial ownership in accordance with the rules of the SEC. Under SEC rules, beneficial ownership for purposes of this table takes into account shares as to which the individual has voting or investment power as well as shares that may be acquired within 60 days. Shares of Common Stock subject to options that are currently exercisable or that become exercisable within 60 days of June 3, 2013April 24, 2015 are treated as outstanding and beneficially owned by the holder of such options. However, these shares are not treated as outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated or as to the interests of spouses, the persons included in the table have sole voting and investment power with respect to all shares beneficially owned thereby.

NUMBER OF SHARES OF COMMON STOCK BENEFICIALLY OWNED

NAME OF BENEFICIAL OWNER* |

| NUMBER OF SHARES OF COMMON STOCK BENEFICIALLY OWNED (1) |

| PERCENT OF SHARES OF COMMON STOCK OUTSTANDING (2) |

|

| NUMBER OF SHARES OF COMMON STOCK BENEFICIALLY OWNED (1) |

| PERCENT OF SHARES OF COMMON STOCK OUTSTANDING (2) |

| ||||

Sabby Healthcare Volatility Master Fund, Ltd. (3) |

|

| 22,206,204 | 9.9 | % | |||||||||

Max E. Link (4) | 558,631 | ** | % | |||||||||||

EGWU, Inc. f/k/a Egen, Inc. (3) | 2,512,423 | 12.6 | % | |||||||||||

Sabby Healthcare Master Fund, Ltd. (4) |

|

| 1,995,657 |

|

| 9.9 | % | |||||||

Augustine Chow (5) | 220,751 | ** |

|

| 95,903 |

|

| ** |

| |||||

Robert W. Hooper (6) | 187,502 | ** |

|

| 94,753 |

|

| ** |

| |||||

Alberto Martinez (7) | 225,376 | ** |

|

| 113,412 |

|

| ** |

| |||||

Frederick J. Fritz (8) | 73,501 | ** |

|

| 89,884 |

|

| ** |

| |||||

Michael H. Tardugno (9) | 1,122,037 | 2.04 | % |

|

| 507,202 |

|

| 2.5 | % | ||||

Gregory Weaver (10) | 157,710 | ** | ||||||||||||

Nicholas Borys (11) | 313,188 | ** | ||||||||||||

Jeffrey Church (12) | 171,788 | ** | ||||||||||||

Directors and Executive Officers as a group (9persons)(13) | 3,074,371 | 5.60 | % | |||||||||||

Nicholas Borys (10) |

|

| 170,698 |

|

| ** | ||||||||

Jeffrey Church (11) |

|

| 171,733 |

|

| ** |

| |||||||

Khursheed Anwer (12) | 22,500 | ** |

| |||||||||||

Estate of Max E. Link (13) |

|

| 151,761 |

|

| ** |

| |||||||

Directors and Executive Officers as a group (ten persons)(14) |

|

| 1,471,595 |

|

| 7.4 | % | |||||||

* |

| The address of each of the individuals named is c/o Celsion Corporation, 997 Lenox Drive, Suite 100, Lawrenceville, NJ 08648. |

|

|

|

** |

| Less than |

|

|

|

(1)

|

| Beneficial Ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them. |

(2)

Based on 61,154,295 shares of Common Stock outstanding as of June 3, 2013.

|

|

|

(3) | Based solely on the Schedule 13G filed with the SEC on June 30, 2014 and the Form 4 filed with the SEC on February 24, 2015 by EGWU, Inc. (formerly known as Egen, Inc.), an Alabama corporation (“EGEN”). EGEN has the sole voting power and sole dispositive power with respect to 2,512,423 shares of Common Stock. The address of EGEN is 601 Genome Way, Suite 3400, Huntsville, Alabama 35806. | |

(4) | Based on the Schedule 13G/A (Amendment No. 2) filed with the SEC on January 8, 2015 by Sabby Healthcare | |

| ||

|

| Includes |

|

| |

(6) |

| Includes |

(7) |

| Includes |

(8) |

| Includes |

(9) |

| Includes |

(10) |

| Includes |

|

| |

|

| Includes |

(12) | Includes 17,500 shares of Common Stock underlying options currently exercisable or exercisable within 60 days of April 24, 2015. | |

(13) | Includes 84,525 shares of Common Stock and 67,236 shares of Common Stock underlying options currently exercisable which are included in the estate of Max E. Link, Ph.D., former Chairman of the Board of Directors of the Company, after his passing in October 2014. These options for 67,236 shares of Common Stock, if not exercised, will expire on October 6, 2015. | |

(14) | Includes 1,155,156 shares of Common Stock underlying options and warrants currently exercisable or exercisable within 60 days of | |

|

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's executive officers and directors and persons who beneficially own more than 10% of a registered class of our equity securities to file reports with the SEC regarding ownership and changes in ownership of such equity securities. Executive officers, directors and greater than 10% stockholders are required by SEC regulations to furnish to us copies of all reports that they file pursuant to Section 16(a). Subject to the following sentence, basedBased solely on our review of the copies of such forms furnished between January 1, 2012 and December 31, 2012, orto us with respect to our fiscal year ended December 31, 2012,2014, and on our discussions with directors and executive officers, we believe that, during the fiscal year ended December 31, 2012,2014, all applicable Section 16(a) filing requirements were timely met.

CODE OF ETHICS

The Company has adopted a Code of Ethics and Business Conduct (the “Code of Ethics”) applicable to its directors, officers, (including itsincluding the Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and other officers performing similar functions)functions, and employees. This Code of Ethics constitutes a code of ethics applicable to senior financial officers within the meaning of the Sarbanes-Oxley Act of 2002 and SEC rules. A copy of the Code of Ethics and Business Conduct is available on the Company's website athttp://www.celsion.com and any stockholder may obtain a copy by making a written request to the Company's Corporate Secretary, 997 Lenox Drive, Suite 100, Lawrenceville, NJ 08648. In the event of any amendments to or waivers of the terms of the Code of Ethics, such matters will be posted promptly to the Company's website in lieu of disclosure on Form 8-K in accordance with Item 5.05(c) of Form 8-K.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Code of Ethics requires all of the Company’s directors, officers and employees to give their complete loyalty to the best interests of the Company and to avoid any action that may involve, or that even may appear to involve, a conflict of interest with the Company. The Code of Ethics also requires any of the Company’s directors, officers or employees who become aware of a conflict or potential conflict to bring it to the attention of a supervisor, manager or other appropriate personnel or consult the compliance procedures provided in the Code of Ethics. The Board of Directors reviews and approves or ratifies all relationships and transactions between us and (i) any of our directors or executive officers, (ii) any nominee for election as a director, (iii) any security holder who is known to us to own beneficially or of record more than five percent of our common stock or (iv) any member of the immediate family of any of the foregoing.

On January 21, 2014, the Company sold and issued, in registered direct offerings, to Sabby Healthcare Volatility Master Fund, Ltd. and Sabby Volatility Warrant Master Fund, Ltd. (collectively, the “Sabby Volatility Funds”), (i) a total of 1,681,682 shares of Common Stock and (ii) warrants to purchase a total of 840,842 shares of Common Stock at an exercise price of $4.10 per share, for total consideration of $7,000,001.33. Certain affiliates of the Sabby Volatility Funds beneficially own more than five percent of the outstanding shares of Common Stock.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

GENERAL

The Company's Certificate of Incorporation provides that the number of directors that constitutes the Board of Directors is to be fixed by, or in the manner provided in, our Bylaws, as amended (the "Bylaws"). The Certificate of Incorporation also provides that the Board of Directors is to be divided into three classes, designated as Class I, Class II and Class III, and it is the Company's practice to have such classes as even in size as possible. The Company's Bylaws provide that the Board of Directors is to consist of between three and nine directors, with the exact number to be fixed by action of the Board of Directors. The current number of directors has been fixed by the Board of Directors at seven. Currently, the Company’s Board of Directors consists of five directors as two Board seats remain vacant.

The Board of Directors have nominated Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. TardugnoAlberto R. Martinez to stand for re-election to the Board of Directors as Class IIIII Directors, with terms expiring at the 2016 Annual Meeting of Stockholders to be held in 2018 and with the election and qualification of their respective successors. The proxies named in the Proxy Card provided with this Proxy Statement intend to vote "FOR" the election of Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. TardugnoAlberto R. Martinez unless otherwise instructed. If you do not wish your shares to be voted for Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. Tardugno,Alberto R. Martinez, you must so indicate by marking the "WITHHOLD" authority box on the Proxy Card next to Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. TardugnoAlberto R. Martinez in which event your shares will not be voted for Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. Tardugno.Alberto R. Martinez. In the event that Mr. Robert W. Hooper and Dr. Max E. Link and Mr. Michael H. TardugnoAlberto R. Martinez become unavailable which is not expected,for election as a result of an unexpected occurrence, the designated proxies will vote in their discretion for a substitute nominee, or the Board may reduce the number of directors serving on the Board.

Class IIIII Director Nominees (If elected, term would expire in 2016)2018)

Dr. Max E. Link. Dr. Link has served as a director of the Company since 1997 and has been the Chairman of the Board of Directors since October 2001. Dr. Link currently serves on the board of directors of a number of pharmaceutical and biotechnology companies. From 1993 to 1994, Dr. Link served as Chief Executive Officer of Corange, Ltd., a life science company that was subsequently acquired by Hoffmann-La Roche. From 1971 to 1993, Dr. Link served in numerous positions with Sandoz Pharmaceuticals (currently the generic division of Novartis), culminating in his appointment as Chairman of its Board of Directors in 1992. From 2001 to 2003, Dr. Link served as Chairman and Chief Executive Officer of Centerpulse Ltd. Dr. Link currently serves as Chairman of the Board of Directors of each of Alexion Pharmaceuticals, Inc. and Cytrx Corporation. Dr. Link holds a Ph.D. in Economics from the University of St. Gallen (Switzerland).

Mr. Michael H. Tardugno. Mr. Tardugno was appointed President and Chief Executive Officer of the Company on January 3, 2007 and was elected to the Board of Directors on January 22, 2007. Prior to joining the Company and for the period from February 2005 to December 2006, Mr. Tardugno served as Senior Vice President and General Manager of Mylan Technologies, Inc., a subsidiary of Mylan Inc. From 1998 to 2005, Mr. Tardugno was Executive Vice President of Songbird Hearing, Inc., a medical device company spun out of Sarnoff Corporation. From 1996 to 1998, he was Senior Vice President of Technical Operations world wide for a division of Bristol-Myers Squibb, and from 1977 to 1995, he held increasingly senior executive positions including Senior Vice-President of World-wide Technology Development and Manufacturing with Bausch & Lomb and Abbott Laboratories. Mr. Tardugno holds a B.S. degree in Biology from St. Bonaventure University and completed the Harvard Business School Program for Management Development.

The Board of Directors concluded that each of Dr. Link and Mr. Tardugno has the requisite experience, qualifications, attributes and skill necessary to serve as a member of the Board of Directors based on, among other things, his:

|

| |

|

|

|

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL NOMINEES NAMED ABOVE.

|

Set forth below is certain information regarding the Company's current directors and the nominees (who are currently serving as directors), as well as the Company's non-director executive officers.

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

| |||

|

|

| |||

|

|

|

Continuing Class I Directors (Term Expires in 2014)

Dr. Augustine Chow. Dr. Augustine Chow was appointed to the Board of Directors in March 2007. Dr. Chow has served as the Chief Executive Officer of Harmony Asset Limited since 1996, an investment company listed on the Toronto Stock Exchange and the Hong Kong Stock Exchange and specializing in China and Hong Kong. Dr. Chow has served as Executive Director of Kaisun Energy Group Ltd. since 2008 and currently serves as an independent director of Medifocus Inc. From 1990 to 1998, Dr. Chow was the Chief Executive Officer of Allied Group of Companies based in Hong Kong. Prior to this, Dr. Chow held a senior position with Brunswick Corporation and Outboard Marine Corporation and was responsible for all business activities in South East Asia and China. Dr. Chow’s qualifications include a number of Bachelors, Masters and Doctoral degrees. Among them include a MSc from London Business School, a Ph.D. in the Transfer of Technology from the University of South Australia, and an Engineering Doctorate and Ph.D. from City University of Hong Kong.

Mr. Frederick J. Fritz. Mr. Fritz was appointed to the Board of Directors in July 2011. Mr. Fritz is currently the CEO & Founder of NeuroDx, a development stage diagnostic device company focused on the neurosurgery market. Mr. Fritz joined NeuroDx from Valeo Medical, a biotech company he founded in 2003 to develop the world's first non-invasive diagnostic test for endometriosis. Prior to that, Mr. Fritz was President and CEO of Songbird Hearing, a medical device company spun out of Sarnoff Corporation. Mr. Fritz began his career in marketing management and new product development. He joined Schering Plough's Wesley Jessen in 1985 as VP Marketing and Sales in 1986. He was promoted to general manager of Schering's Over the Counter pharmaceutical business in 1988 and of the podiatric products business in 1990. He was President of Coleman North America from 1995-1997. Mr. Fritz holds a Bachelor’s degree in engineering (summa cum laude) from University of Illinois and an MBA degree from Harvard University.

Continuing Class II Directors (Term Expires in 2015)

Mr. Robert W. Hooper. Mr. Hooper has served as a directormember of the CompanyBoard of Directors since July 2010. He is currently President of Crows Nest Ventures, Inc. a privately held company, which provides advisory and consulting services to the healthcare industry. From 1997 to 2001, Mr. Hooper served as President North America for IMS Health Incorporated, a healthcare information and market research company listed on The New York Stock Exchange. From 1993 to 1997, he served as President of Abbott Laboratories Canada. From 1989 to 1993, he served as Managing Director, Australia/Asia for Abbott Laboratories. Prior to that, he held increasingly senior positions at E.R. Squibb and Sterling Winthrop Labs. Mr. Hooper holds a B.A degree in Biology from Wilkes University.

Dr. Alberto R. Martinez. Dr. Martinez has served as a directormember of the CompanyBoard of Directors since December 2010. He is currently a consultant to the healthcare industry. From 2007 to 2008, Dr. Martinez served as the President and Chief Operating Officer of Talecris Biotherapeutics, Inc., a publicly traded life science company. Prior to that, Dr. Martinez served as Talecris’ President and Chief Executive Officer from October 2005 until June 2007. Prior to that, he held increasingly senior positions as Executive Vice President of Worldwide Commercial Operations at ZLB Behring (subsequently renamed CSL Behring). Prior to ZLB Behring, Dr. Martinez served in various international positions at Sandoz Pharmaceuticals (currently the generic pharmaceuticals division of Novartis) in Brazil, Switzerland, Spain and the U.S. for eighteen years. Dr. Martinez completed his undergraduate and graduate studies at the University of Sao Paulo and received his medical degree from the University of Sao Paulo in 1973. After completing his residency in Pediatrics in 1975, he studied Business and Marketing Administration at the Fundacao Getulio Vargas in Sao Paulo, Brazil.

The Board of Directors concluded that each of Mr. Robert W. Hooper and Dr. Alberto R. Martinez has the requisite experience, qualifications, attributes and skill necessary to serve as a member of the Board of Directors based on, among other things, his:

● | Leadership attributes and management experience; | |

● | Management experience in the pharmaceutical industry; and | |

● | Professional and educational background. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”THE ELECTION OF ALL NOMINEES NAMED ABOVE.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Set forth below is certain information regarding the Company's current directors and the nominees (who are currently serving as directors), as well as the Company's non-director executive officers.

NAME | AGE | POSITION(S) | CLASS | ||

Michael H. Tardugno | 64 | Chairman, President and Chief Executive Officer | III | ||

Robert W. Hooper | 68 | Director | II | ||

Alberto R. Martinez, M.D. | 65 | Director | II | ||

Augustine Chow, Ph.D. | 62 | Director | I | ||

Frederick J. Fritz | 64 | Director | I | ||

Khursheed Anwer, Ph.D. MBA | 55 | Executive Vice President and Chief Scientific Officer | |||

Nicholas Borys, M.D. | 55 | Senior Vice President and Chief Medical Officer | |||

Jeffrey W. Church | 58 | Senior Vice President and Chief Financial Officer |

Continuing Class I Director Nominees (Term Expires in 2017)

Dr. Augustine Chow. Dr. Chow has served as a director of the Company since March 2007. Dr. Chow has served as the Chief Executive Officer of Harmony Asset Limited since 1996, an investment company listed on the Hong Kong Stock Exchange and specializing in China and Hong Kong. Dr. Chow has served as Executive Director of Kaisun Energy Group Ltd. since 2008 and currently serves as a director of Medifocus Inc. From 1990 to 1998, Dr. Chow was the Chief Executive Officer of Allied Group of Companies based in Hong Kong. Prior to this, Dr. Chow held a senior position with Brunswick Corporation and Outboard Marine Corporation and was responsible for all business activities in South East Asia and China. Dr. Chow’s qualifications include a number of Bachelors, Masters and Doctoral degrees. Among them include a MSc from London Business School, a Ph.D. from the University of South Australia, and an Engineering Doctorate and Ph.D. on Biology from City University of Hong Kong.

Mr. Frederick J. Fritz. Mr. Fritz has served as a director of the Company since July 2011. Mr. Fritz is currently the CEO and Founder of NeuroDx, a development stage diagnostic device company focused on the neurosurgery market. Mr. Fritz joined NeuroDx from Valeo Medical, a biotech company he founded in 2003 to develop the world's first non-invasive diagnostic test for endometriosis. Prior to that, Mr. Fritz was President and CEO of Songbird Hearing, a medical device company spun out of Sarnoff Corporation. Mr. Fritz began his career in marketing management and new product development. He joined Schering Plough's Wesley Jessen in 1985 as VP Marketing and Sales in 1986. He was promoted to general manager of Schering's Over the Counter pharmaceutical business in 1988 and of the podiatric products business in 1990. He was President of Coleman North America from 1995-1997. Mr. Fritz holds a Bachelor’s degree in engineering (summa cum laude) from University of Illinois and an MBA degree from Harvard University.

Continuing Class III Directors (Term Expires in 2016)

Mr. Michael H. Tardugno. Mr. Tardugno was appointed President and Chief Executive Officer of the Company on January 3, 2007 and was elected to the Board of Directors on January 22, 2007. In October of 2014, Mr. Tardugno was appointed by the Board of Directors as the Chairman as successor to Max E. Link, Ph.D., who passed away in October 2014. Prior to joining the Company and for the period from February 2005 to December 2006, Mr. Tardugno served as Senior Vice President and General Manager of Mylan Technologies, Inc., a subsidiary of Mylan Inc. From 1998 to 2005, Mr. Tardugno was Executive Vice President of Songbird Hearing, Inc., a medical device company spun out of Sarnoff Corporation. From 1996 to 1998, he was Senior Vice President of Technical Operations worldwide for a division of Bristol-Myers Squibb, and from 1977 to 1995, he held increasingly senior executive positions including Senior Vice-President of World-wide Technology Development with Bausch & Lomb and Abbott Laboratories. Mr. Tardugno holds a B.S. degree from St. Bonaventure University and completed the Harvard Business School Program for Management Development.

The Board of Directors concluded that all of the continuing directors have the requisite experience, qualifications, attributes and skill necessary to serve as a member of the Board of Directors based on, among other things, his:

| ● | Leadership attributes and experience |

| ● | Management experience in the pharmaceutical industry and/or business experience in countries in which the Company is conducting its clinical trials; and |

| ● | Professional and educational background. |

Executive Officers

Following are the biographical summaries for each of the Company's executive officers. Each executive officer is elected by, and serves at the pleasure of the Board of Directors.

Mr. Michael H. Tardugno. Mr. Tardugno’s biographical information appears above under the heading “Class“Continuing Class III Directors”.

Khursheed Anwer, Ph.D., M.B.A. Dr. Anwer joined Celsion on June 20, 2014 as Executive Vice President and Chief Scientific Officer, in connection with the Company’s acquisition of all the assets of EGWU, Inc. (formerly known as Egen, Inc.), an Alabama corporation (“EGEN”). Before joining Celsion, Dr. Anwer served as EGEN’s President and Chief Scientific Officer, a position he held since 2009. He joined EGEN in July, 2002 as Vice President of Research and Development, and directed the company’s clinical and research and development functions. Before joining EGEN, Inc., Dr. Anwer was Director Nominees”.of Pre-Clinical Development at Valentis, Inc. from July 2000 to June 2002. From 1993 to 1999, he served in several positions at GeneMedicine, Inc., where he led several research projects in the area of non-viral gene therapy. He has authored more than 40 publications in the area of non-viral gene therapy, resulting from his active career in research and development. Dr. Anwer has a Ph.D. in Physiology/Pharmacology from Ohio University and received post-doctoral training from the University of Texas Health Science Center at Houston.

Dr. Nicholas Borys. Dr. Borys joined Celsion on October 1, 2007 as Vice President and Chief Medical Officer of the Company.Company and was promoted to Senior Vice President in June 2014. In this position, Dr. Borys manages the clinical development and regulatory programs for Celsion. Dr. Borys has over 20 years of experience in all phases of pharmaceutical development with a focus on oncology. Immediately prior to joining Celsion, Dr. Borys served as Chief Medical Officer of Molecular Insight Pharmaceuticals, Inc., a molecular imaging and nuclear oncology pharmaceutical company, from 2004 until 2007. From 2002 until 2004 he served as the Vice President and Chief Medical Officer of Taiho Pharma USA, a Japanese start-up oncology therapeutics company. Prior to that he held increasingly senior positions at Cytogen Corporation, Anthra Pharmaceuticals, Inc., Amersham Healthcare, Inc. and Hoffmann La-Roche Inc. Dr. Borys obtained his premedical degree from Rutgers University and holds an M.D. degree from American University of the Caribbean.

Mr. Gregory Weaver.Jeffrey W. Church. Mr. Weaver has servedChurch joined Celsion in July 2010 as Celsion’s Senior Vice President, and Chief Financial Officer since July 2011 and was a director and Chairman of the Audit Committee on the Board of the Company from 2005 to 2011. From February 2009 to August 2010, Mr. Weaver served as Senior Vice President and Chief Financial Officer of Poniard Pharmaceuticals, a public oncology drug development company. From 2007 to 2008, Mr. Weaver served as Chief Financial Officer of Talyst, Inc., a privately-held pharmacy information product company. In 2006, he served as Senior Vice President and Chief Financial Officer of Sirna Therapeutics, a public RNAI therapeutics company until it was acquired by Merck & Co., Inc. in December 2006. From 2002 to 2005, Mr. Weaver was Chief Financial Officer of Nastech Pharmaceuticals, a public drug delivery company. From 1999 to 2002, Mr. Weaver was Chief Financial Officer of Ilex Oncology Inc., a public oncology drug development company, and from 1996 to 1998, he was Chief Financial Officer of Prism Technologies, a privately-held medical device company. Prior to that, Mr. Weaver held increasingly senior positions with Fidelity Capital and Arthur Andersen LLP. Mr. Weaver also served as a director and Chairman of the Audit Committee of SCOLR Pharmaceuticals, a public drug delivery company from 2007 to 2009. Mr. Weaver is a Certified Public Accountant and received his MBA degree from Boston College and his B.S. in accounting from Trinity University.

Mr. Jeffrey W. Church. Corporate Secretary. Mr. Church was appointed as Senior Vice President, Corporate Strategy and Investor Relations effective July 8, 2011. On July 1, 2014, Mr. Church joined Celsion in July 2010was reappointed as Senior Vice President and Chief Financial Officer and Corporate Secretary.Officer. Immediately prior to joining Celsion, Mr. Church served as Chief Financial Officer and Corporate Secretary of Alba Therapeutics Corporation, a privately held life science company from 2007 until 2010. From 2006 until 2007, he served as Vice President, CFO and Corporate Secretary for Novavax, Inc., a vaccine development company listed on The NASDAQ Global Select Market. From 1998 until 2006, he served as Vice President, CFO and Corporate Secretary for GenVec, Inc., a life science and biotechnology company listed on The NASDAQ Capital Market. Prior to that, he held senior financial positions at BioSpherics Corporation and Meridian Medical Technologies, both publicly traded companies. He started his career with Price Waterhouse from 1979 until 1986. Mr. Church holds a B.S. degree in accounting from the University of Maryland and is a Certified Public Accountant.

LEGAL PROCEEDINGS

None of the Company's directors or officers has been a part of any legal proceeding within the last 10 years that is subject to disclosure under Item 401(f) of Regulation S-K.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Board Leadership

Our Board of Directors has adopted a leadership structurebelieves that it believes is appropriate for Celsion, including an independent Chairman of the Board. Currently, Dr. Link serves asimportant to select its Chairman of the Board and the Company’s Chief Executive Officer in the manner it considers in the best interests of the Company at any given point in time. The members of the Board possess considerable business experience and in-depth knowledge of the issues the Company faces and are therefore in the best position to evaluate the needs of the Company and how best to organize and adopt the Company’s leadership structure to meet those needs. Accordingly, the Chairman and the Chief Executive Officer may be filled by one individual or by two different individuals, and the Chairman may be a Company insider or an independent director.

On October 6, 2014, the Company announced the passing of Max E. Link, Ph.D., who had served as the Chairman of the Board of Directors for the last 13 years. Following Dr. Link’s passing, the Board of Directors appointed Mr. Michael H. Tardugno to serve as Chairman of the Board. Mr. Tardugno serveswill continue to serve as President and Chief Executive Officer.Officer of the Company. The Board believes that the Company and its stockholders have been well served by the current leadership structure due to Dr. Link's and Mr. Tardugno's experience and in-depth knowledge of the Company and the industry. The Company believes that at this time the separation of these roles permits the Chairman of the Board to focus on oversight of the Company’s long-term corporate development goals while the President and Chief Executive Officer focuses on the strategic direction of the Company and oversees the day to day performance of the other executive officers in executing the Company’s business plan.

Board Oversight of Risk

The Board of Directors is responsible for oversight of the various risks facing us.the Company. In this regard, the Board seeks to understand and oversee the most critical risks relating to our business and operations, allocate responsibilities for the oversight of risks among the full Board and its committees, and see that management has in place effective systems and processes for managing risks facing the Company. Overseeing risk is an ongoing process, and risk is inherently tied to our strategy and to strategic decisions. Accordingly, the Board considers risk throughout the year and with respect to specific proposed actions. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk-taking is essential for the Company to be competitive and to achieve its business objectives.

While the Board oversees risk, management is charged with identifying and managing risk. We have robust internal processes and a strong internal control environment to identify and manage risks and to communicate information about risk to the Board. Management communicates routinely with the Board, Board committees and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management.

The Board implements its risk oversight function both as a whole and through delegation to various committees. These committees meet regularly and report back to the full Board. OurThe Audit Committee oversees the management of financial, accounting, internal controls, disclosure controls and the engagement arrangement and regular oversight of the independent auditors. The Compensation Committee (as described below) play significant roles in carrying outis responsible for the riskdesign and oversight function.of the Company’s compensation programs. Based on a review of our company-wide compensation programs, including the compensation programs for our executive officers, the Compensation Committee has concluded that these programs do not create risks that are likely to have a material adverse effect on the Company. The Nominating and Governance Committee periodically reviews the Company’s corporate governance practices, including the risks that those practices are intended to address. It also periodically reviews the composition of the Board of Directors to help ensure that a diversity of skills and experiences is represented by the members of the Board of Directors taking into account the stage of growth of the Company and its strategic direction.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors presently maintains separately designated Audit, Compensation, and Nominating and Governance Committees.

Audit Committee

The Audit Committee consists of Dr. Max Link,Mr. Frederick J. Fritz, Chairman, Dr. Augustine Chow and Mr. Frederick J. Fritz.Dr. Alberto R. Martinez. The Audit Committee operates under a written charter as amended and restated effective May 4, 2007. A copy of the charter, as may be amended from time to time, is available on our web site, located athttp://www.celsion.com, in lieu of triennial filing with our proxy statement in accordance with Instruction 2 to Item 407 of Regulation S-K. Additional copies of the charter are available upon written request to the Company. All members of the Audit Committee meet the independence standards established by the SEC and NASDAQ.

The Audit Committee assists the Board in fulfilling its responsibility to oversee management's implementation of the Company's financial reporting process. In discharging its oversight role, the Audit Committee reviewed and discussed the audited financial statements contained in the Company's 20122014 Annual Report on Form 10-K with the Company's management and the Company's independent registered public accounting firm. Management is responsible for the financial statements and the reporting process, including the system of internal controls. The Company's independent registered public accounting firm is responsible for expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

The Board of Directors has determined that Dr. Max LinkMr. Fritz is qualified to serve as the "audit committee financial expert" as defined by Item 407(d)(5) of Regulation S-K and that Dr.Drs. Chow and Mr. FritzMartinez meet the financial literacy requirements under applicable NASDAQ rules.

Compensation Committee

The Compensation Committee is responsible for establishing and administering the compensation policies applicable to the Company's directors, officers and key personnel, for recommending compensation arrangements to the Board of Directors and for evaluating the performance of senior management. The Compensation Committee operates under a written charter effective as of December 24, 2003. A copy of the charter, as may be amended from time to time, is available on our web site, located athttp://www.celsion.com , in lieu of triennial filing with our proxy statement in accordance with Instruction 2 to Item 407 of Regulation S-K. Additional copies of the charter are available upon written request to the Company. The Compensation Committee does not delegate the authority to approve compensation policies and actions affecting the Company's named executive officers or directors. The Compensation Committee applies discretion in determining compensation for the Company's executives. The Compensation Committee has not established any equity or other security ownership requirements or guidelines in respect of its executive officers. The Chairman, President and Chief Executive Officer assists the Compensation Committee in evaluating the performance of other executive officers and by providing information to directors as and when requested, such as salary surveys and compensation paid by the Company's competitors, to the extent such information is publicly available. Members of the Compensation Committee undertake to verify such information prior to referring to it in determining executive compensation. The compensation of the Chairman, President and Chief Executive Officer is determined by the Compensation Committee based on the Compensation Committee's evaluation of his performance and with reference to such external or competitive data as they consider necessary. The compensation of the other named executive officers is determined by the Compensation Committee based on its evaluation of their individual performance and the recommendations of the Chairman, President and Chief Executive Officer.

Mr. Hooper (Chairman) and Drs. LinkChow and Martinez currently comprise the Compensation Committee. All members of the Compensation Committee are independent under the applicable NASDAQ rules.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for identifying and recruiting new members of the Board of Directors when vacancies arise, identifying and recruiting nominees for election as directors, reconsideration of incumbent directors in connection with nominations for elections of directors and ensuring that the Board of Directors is properly constituted to meet its corporate governance obligations. The Nominating and Governance Committee operates under a written charter effective as of December 24, 2003 and amended on February 27, 2006. A copy of the charter, as may be amended from time to time, is available on our web site, located athttp://www.celsion.com , in lieu of triennial filing with our proxy statement in accordance with Instruction 2 to Item 407 of Regulation S-K. The current members of the Nominating and Governance Committee are Dr. Link (Chairman)Mr. Fritz and Dr. Martinez, each of whom is deemed to be independent under applicable NASDAQ rules.

MEETINGS OF THE BOARD AND ITS COMMITTEES

During the year ended December 31, 2012,2014, there were a total of sixfive regular meetings of the Board of Directors. Dr.’sAll of our directors, including Max E. Link, Chow and Martinez, and Messer’s Tardugno, Hooper and FritzPh.D. before he passed away in October 2014, attended all of the meetings of the Board of Directors and the committees on which they served that were held during the period for which they were a director or committee member, respectively. During the year ended December 31, 2012,2014, the Audit Committee met four times, the Compensation Committee met twice and the Nominating and Governance Committee met once.

DIRECTOR NOMINATIONS

The Nominating and Governance Committee

The role of the Nominating and Governance Committee is to act on behalf of the Board of Directors to ensure that the Board of Directors and its standing committees are appropriately constituted to meet their fiduciary and corporate governance obligations. In this role, the Nominating and Governance Committee is responsible for identifying and recruiting new members of the Board of Directors when vacancies arise, identifying and recruiting nominees for election as directors and reconsidering incumbent directors in connection with nominations for elections of directors. The Nominating and Governance Committee is also charged with: (i) reviewing and recommending changes in the size and composition of the Board of Directors and its committees; (ii) developing and maintaining criteria and processes for selecting candidates for election as directors; (iii) identifying and recruiting candidates to stand for election as directors and determining whether incumbent directors should stand for reelection; (iv) ensuring that the Company and the Board of Directors operatesoperate in accordance with current best practices; (v) providing for ongoing director training and education; (vi) reporting to the Board of Directors on Nominating and Governance Committee activities; (vii) annually reviewing the Nominating and Governance Committee's performance of its responsibilities and duties; and (viii) annually reviewing the Nominating and Governance Committee Charter, the structure and the processes and membership requirements of the Nominating and Governance Committee and recommending to the Board any improvements or amendments that the Nominating and Governance Committee considers appropriate or necessary.

Director Qualifications

It is a policy of the Nominating and Governance Committee that candidates for director be determined to have unquestionable integrity and the highest ethical character. Candidates must demonstrate the ability to exercise sound, mature and independent business judgment in the best interests of the stockholders as a whole and may not have any interests that would, in the view of the Nominating and Governance Committee, impair their ability to exercise independent judgment or otherwise discharge the fiduciary duties owed as a director. Candidates must have experience and demonstrated achievement in one or more fields of business, professional, governmental, communal, scientific or educational endeavors which will complement the talents of the other members of the Board of Directors and further the interests of the Company, bearing in mind the composition of the Board of Directors and the current state of the Company and the biotechnical/biopharmaceutical industry generally. In particular, the Nominating and Governance Committee believes it is important for one or more members of the Board of Directors to have in-depth experience in the biotechnical/biopharmaceutical industry. The Nominating and Governance Committee has determined that one or more of its members, including the incumbents nominated to stand for reelection at the Annual Meeting, have such biotechnical/biopharmaceutical experience.

Candidates are expected to have an appreciation of the major issues facing public companies of a size and operational scope similar to the Company, including contemporary governance concerns, regulatory obligations of a public issuer, strategic business planning, competition in a global economy, and basic concepts of corporate finance. Candidates must also have the willingness and capability to devote the time necessary to participate actively in meetings of the Board of Directors and committee meetings and related activities, the ability to work professionally and effectively with other members of the Board of Directors and Company management, and the ability and intention to remain on the Board of Directors long enough to make an effective contribution. Among candidates who meet the foregoing criteria, the Nominating and Governance Committee also considers the Company's current and anticipated needs, including expertise, diversity and balance of inside, outside and independent directors.

Although theThe Nominating and Corporate Governance Committee, does not have a formalencouraging diversity, policy, it endeavors to comprise the Board of Directors of members with a broad mix of professional and personal backgrounds. Thus, the Nominating and Corporate Governance Committee accords some weight to the individual professional background and experience of each director. Further, in considering nominations, the Nominating and Corporate Governance Committee takes into account how a candidate’s professional background would fit into the mix of experiences represented by the then-current Board of Directors. When evaluating a nominee’s overall qualifications, the Nominating and Corporate Governance Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily required of all prospective nominees. In addition to the aforementioned criteria, when evaluating a director for re-nomination to the Board of Directors, the Nominating and Corporate Governance Committee will also consider the director’s history of attendance at board and committee meetings, the director’s preparation for and participation in such meetings, and the director’s tenure as a member of the Board of Directors.

Director Independence

In addition, in accordance with the rules of the SEC and NASDAQ, the Company requires that at least a majority of the directors serving at any time on the Board of Directors be independent, that at least three directors satisfy the financial literacy requirements for service on the Audit Committee and that at least one member of the Audit Committee qualify as an "audit committee financial expert" under those rules.

The Board of Directors has determined that Dr. Max LinkMr. Fritz is qualified to serve as the "audit committee financial expert" as defined by Item 407(d)(5) of Regulation S-K and that Dr. Link, Dr.Mr. Fritz, Drs. Chow and Mr. FritzMartinez meet the financial literacy requirements under applicable SEC and NASDAQ rules. The Board of Directors has also determined that of the sixfive currently serving directors, Drs. Max E. Link, Augustine Chow, Alberto Martinez and Messer’sMessrs. Robert W. Hooper and Frederick J. Fritz, are independent under applicable SEC and NASDAQ rules. Dr. Max LinkMr. Fritz acts as the chairman of our Audit Committee. In considering the independence of the non-employee Director nominated for election, each of Mr. Hooper and Dr. LinkMartinez has no relationship with the Company other than as a Director.

Nominating and Governance Committee Process

In selecting candidates for the Board of Directors, the Nominating and Governance Committee begins by determining whether the incumbent directors whose terms expire at the annual meeting of stockholders desire and are qualified to continue their service on the Board of Directors. Under its charter, the Nominating and Governance Committee is charged with considering incumbent directors as if they were new candidates. However, the Nominating and Governance Committee recognizes the significant value of the continuing service of qualified incumbents in promoting stability and continuity, providing the benefit of the familiarity and insight into the Company's affairs and enhancing the Board of Directors' ability to work as a collective body. Therefore, it is the policy of the Nominating and Governance Committee, absent special circumstances, to nominate qualified incumbent directors whomwho the Nominating and Governance Committee believes will continue to make important contributions to the Board of Directors and who consent to stand for re-election. If any member of the Board of Directors does not wish to continue in service or if the Nominating and Governance Committee or the Board of Directors decides not to re-nominate a member, there is an existing vacancy on the Board of Directors, or the Board of Directors, upon the recommendation of the Nominating and Governance Committee, elects to expand the size of the Board of Directors, the following process would be followed:

| ● | The Nominating and Governance Committee develops a profile for candidates' skills and experience, based on the criteria described above. |

| ● | The Nominating and Governance Committee initiates a search, polling members of the Board of Directors and management, and retaining a search firm if the Nominating and Governance Committee deems this appropriate. |

| ● | The Nominating and Governance Committee has a policy with respect to stockholders' suggestions for nominees for directorships. Under this policy, stockholder nominees are given identical consideration as nominees identified by the Nominating and Governance Committee. |

| ● | The process by which stockholders may submit potential nominees is described below under "Stockholder Recommendation Process." |

| ● | The Nominating and Governance Committee then determines the eligibility and suitability of any candidate based on the criteria described above and the Nominating and Governance Committee's search profile. |

| ● | The Chairman of the Board of Directors and at least one member of the Nominating and Governance Committee interview prospective candidate(s) who satisfy the qualifications described above. |

| ● | The Nominating and Governance Committee offers other members of the Board of Directors the opportunity to interview the candidate(s) and then meets to consider and approve the final candidate(s). |

| ● | The Nominating and Governance Committee seeks endorsement of the final candidate(s) from the full Board of Directors. |

| ● | The final candidate(s) are nominated by the Board of Directors for submission to a stockholder vote or elected to fill a vacancy. |

Stockholder Recommendation Process

The Nominating and Governance Committee will consider for nomination any qualified director candidates recommended by our stockholders. Any stockholder who wishes to recommend a director candidate is directed to submit in writing the candidate’s name, biographical information and relevant qualifications to our Corporate Secretary at our principal executive offices. All written submissions received from our stockholders will be reviewed by the Nominating and Corporate Governance Committee at the next appropriate meeting. The Nominating and Corporate Governance Committee will evaluate any suggested director candidates received from our stockholders in the same manner as recommendations received from management, committee members or members of our board. The Company or the Nominating and Governance Committee may require a stockholder who proposes a nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility or suitability of the proposed nominee to serve as director of the Company. See the section titled “Stockholder Nominations and Proposals for the 20132016 Annual Meeting of Stockholders” later in this Proxy Statement.

Revisions to Nomination Process

The Nominating and Governance Committee and stockholder recommendation processes have been developed to provide a flexible framework to permit the director nomination process to move forward effectively. The Nominating and Governance Committee intends to review these processes from time to time in light of the Company's evolving needs and changing circumstances, as well as changes in legal requirements and stock exchange listing standards. The Nominating and Governance Committee may revise these processes or adopt new ones based on such periodic reviews.

STOCKHOLDER COMMUNICATIONS

The Board of Directors has adopted a process through which interested stockholders may communicate with the Board of Directors. Stockholders who wish to send communications to the Board of Directors, or any particular director, should address such communications to the Corporate Secretary, at the Company's headquarters in Lawrenceville, New Jersey. The envelope containing any such communication should be prominently marked "To the Attention of the Board of Directors" or to a particular committee or director, and the communication should include a representation from the stockholder indicating the stockholder's address and the number of shares of the Company's Common Stock beneficially owned by the stockholder. Our Corporate Secretary is primarily responsible for monitoring communications from stockholders. Depending upon the content of a particular communication, as he deems appropriate, our Corporate Secretary will: (i) forward the communication to the director, directors or committee to whom it is addressed; (ii) attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or (iii) not forward communications such as solicitations, junk mail and obviously frivolous or inappropriate communications. At each meeting of the Board of Directors, the Corporate Secretary will present a summary of all communications, whether or not forwarded, received since the last meeting and will make those communications available to the directors on request.

BOARD ATTENDANCE